Garry Voigt

NEW ZONING RULES WILL MEAN MORE HOUSING OPTIONS!

Proposed New legislation in BC for Small-Scale multi unit housing.

As part of the Homes for People Action Plan this new legislation aims to create more housing options within existing neighbourhoods that are typically zoned only for condos and single-family homes. The plan is to allow zoning to build more multi family units such a townhomes, duplexes and row homes on existing single-family lots.

The aim is to also reduce the limitations and red tape that typically hold up housing projects due to rezoning. The number of homes permitted will depend on the lot size, less than 280 sq metres 3 units and over 280sq metres 4 units. Lots over 280sq metres near transit that has frequent stops could have up to 6 units.

Reach out to us for more information!

WHY IS IT SO IMPORTANT TO HAVE PERSONAL INSURANCE WHEN BUYING A STRATA PROPERTY

Why is it so important to have personal insurance when you buy a strata property?

When you purchase a strata property, the building itself would be covered by the strata insurance policy but what about those items that are not covered?

You will need to have your own insurance for

- All of your personal items, furniture, electronics, clothing etc.

- Additional living expenses – if there is a fire or flood for example and your home is not liveable for a time.

- Betterments and improvements – this will provided coverage for any renovations you have done to the home such as updated flooring, countertops etc. Anything that was not originally put in the unit by the builder but is an upgrade.

- Strata Deductibles – your strata insurance will have deductible amounts, such as water damage. You need to be insured for these deductibles that are payable, they can range from $5,000 to $100,000. For example, if you live in a condo and you have a water leak that damages a unit below, you will be responsible for repairs and you need to be insured for this.

- Personal Liability – This will protect you in the event that someone against you for property damage or bodily injury.

When we receive strata documents there will be a Strata Insurance Summary attached that you would need to send to your insurance broker in order for them to obtain a quote for your personal insurance. Personal insurance is an additional cost but so important in order to protect yourself.

For more information on anything related to Real Estate reach out to Garry Voigt 604 789 2140 or email info@garryvoigt.com

WHY IS IT ESSENTIAL TO READ STRATA DOCUMENTS IF YOU ARE PURCHASING A CONDO OR TOWNHOUSE?

We cannot stress enough how important it is to read strata documents if you are purchasing a condo or a townhouse.

Reading the strata documents will give you a really good idea of the following:

- If there are any upcoming special levies.

- how well the strata council runs the budget,

- how much money there is in the contingency reserve fund,

- if there are any major repairs coming up in the strata or if any major repairs have just been done.

- This is particularly important if you are buying a property in an older building or complex.

When we help you buy a strata property, we request 2 years of strata documents from the listing Agent and these include the following:.

Council minutes: We request 2 years’ worth of minutes from meetings that are held throughout the year where just the strata council meet.

Annual General Meetings: These are minutes from the AGM held once a year with strata council and strata owners. At these meetings owners get to vote on any matters put forward by the strata council.

Special General Minutes: These are minutes of meetings that are held with council members and owners to vote on any matters that cannot wait until the next Annual General Meeting.

Form B: This document confirms the amount of strata fees payable as well as the parking stall & storage locker number (condos), how many units in the complex that are rented and how much money is in the contingency reserve fund – CRF. (The amount of money that strata has to pay for expenses that come up through the year that are not in the budget).

Insurance Summary: You will need this summary when you get your quote for your personal insurance. It sets out the summary of coverage in place for the building and the deductible amounts that would be payable for various occurrences such as water damage. Your insurance broker will be able to give you a quote based on the information set out in the insurance summary.

Financials/Budget: Each year the strata council put together a budget for consistent items that need to be paid for throughout the year. At the AGM owners can vote to approve the budget. The budget you see lists the items that are being paid for and how much is being spent on them. This could include items such as the strata management company, landscaping, garbage pickup etc.

Depreciation Report: This is put together by an engineering company that would be experienced in depreciation reports. They look at all of the components of the building, such as roof, balconies, windows, exterior cladding etc. They also look at the age of the building and put together a proposal on how the strata council could budget for the repair or replacement of the various components in the future.

Engineering/Warranty Reports: Depending on the age of the building there could be a variety of engineering or warranty reports contained withing the strata documents covering various components of the building.

Strata Plan: This is the plan that is registered once the building/complex is complete. It shows the layout of the whole strata and location and size of all the units. Please remember that the strata plan number for the home you are buying is not necessarily the same as your unit number.

It may be a lot of reading but it is essential!!

CHECK OUT EPISODE 3 FROM OUR YOUTUBE SERIES – THE PROCESS OF PURCHASING AN ASSIGNMENT PROPERTY

Check out Episode 3 of our YouTube Series where we discuss the process of purchasing an assignment and what it can mean for you as a buyer.

For more information on assignments reach out to us info@garryvoigt.com – 604789 2140

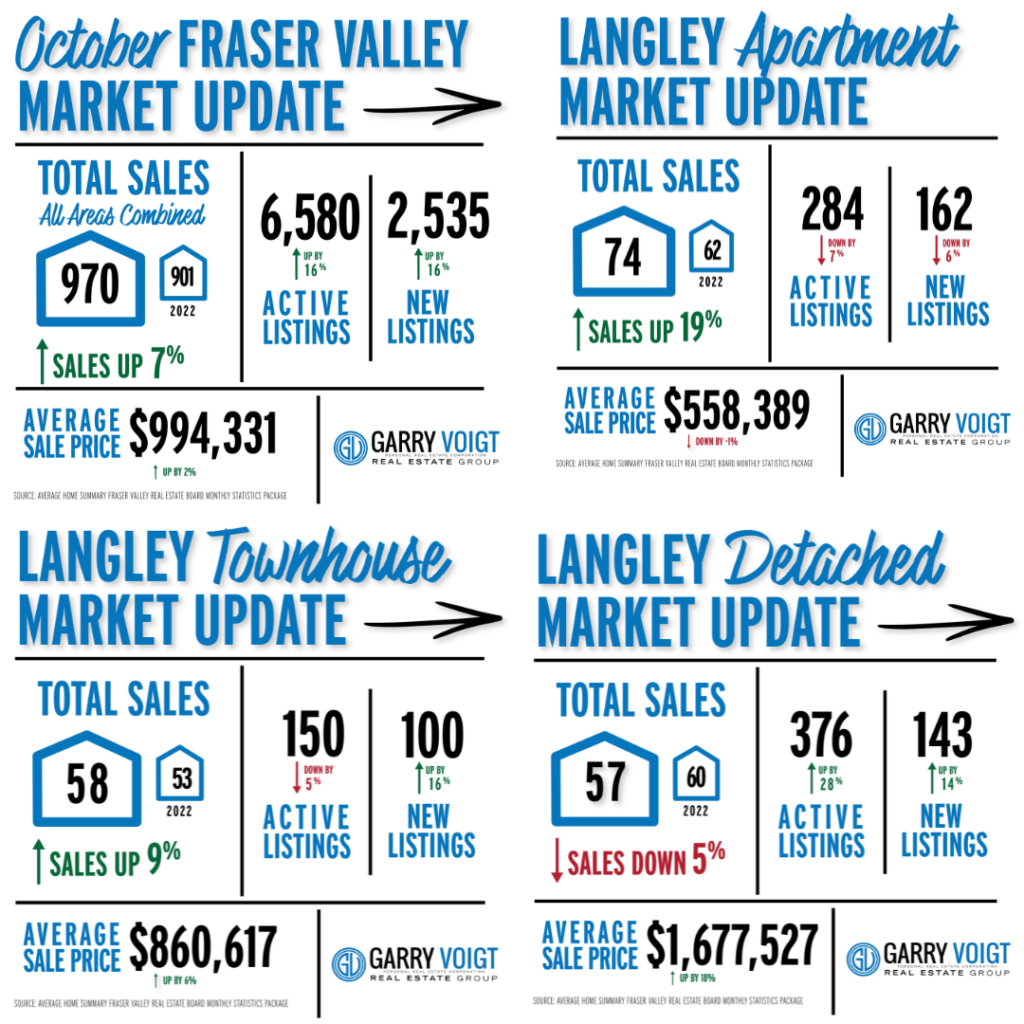

CHECK OUT THE LATEST STATS FOR THE FRASER VALLEY FOR OCTOBER

‘Fraser Valley real estate market weakens as sales and prices continue to edge downward’

SURREY, BC — Property sales and new listings in the Fraser Valley fell again in October as consumers continued to put home buying and selling decisions on hold in the face of elevated interest rates.

The Fraser Valley Real Estate Board recorded 970 transactions on its Multiple Listing Service® (MLS®) in October, a drop of 12 per cent from the previous month and the fourth consecutive decrease since the 12-month high of 1,935 sales recorded in June.

At 2,535, new listings also fell again, decreasing by 11 per cent from September and by 28 per cent since peaking in May at 3,533.

“What we’re seeing in the Fraser Valley and indeed across the province is the impact of sustained high interest rates on the overall market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This has been the case since the latter half of the year so far, and we anticipate the trend will continue until we start to see some downward movement in the policy rate.”

Active listings in October were 6,580, up by less than 1 per cent over last month and up by 17 per cent over October 2022. The sales-to-active listings ratio was 15 per cent, creating balanced conditions in the overall market, with detached houses dipping into buyers’ market territory at 12 per cent. The market is considered balanced when the ratio is between 12 per cent and 20 per cent. “As the market continues to adjust to the new rate realities, pricing and financing strategies become critical,” said FVREB CEO, Baldev Gill. “A knowledgeable professional REALTOR®, armed with the latest comparative market data and neighbourhood insights, can be the key to determining optimal market timing.”

Overall benchmark prices continued to slide for the third month in a row, losing 1.4 per cent compared to September.

For more info on the market reach to Garry Voigt 604 789 2140 email info@garryvoigt.com

CHECK OUT EPISODE 2 OF OUR YOUTUBE SERIES – BUYING A FORECLOSURE PROPERTY.

Check out episode 2 of our YouTube series where we discuss the pros and cons and the potential pitfalls of buying a foreclosure or cour ordered sale property.

For more information on purchasing a foreclosure contact Garry Voigt info@garryvoigt.com – 604 789 2140

WHAT IS THE LEAST EXPENSIVE WAY TO INCREASE YOUR RETURN ON INVESTMENT WHEN SELLING A HOME

DECLUTTER/DEPERSONALIZE – We often get asked ‘what the best thing is we can do for the biggest return on investment when we sell out property’. Our number 1 answer is always declutter and depersonalize your home. We can never stress enough how important this step is when selling a home.

This can be as simple as grabbing some packing boxes and storing items in your garage. If you are in a condo, fill up your storage locker. If you don’t have the space, it may be worthwhile renting a storage locked for a short period of time. We always say, ‘less is more’, when there is a lot of clutter it can be hard for buyers to see past this and imagine themselves living in your home.

CLEAN -The 2nd recommendation we always make is to clean your home. In our experience, some buyers find it hard to see past a home that is not clean. This is especially important if you have pets in your home. It doesn’t have to be a huge expense but depending on your situation we would recommend hiring a professional cleaning company.

If you are thinking of selling, reach out to us and we will be happy to help you with tips on how to get the best return on your investment!

JUST LISTED 19 19628 55A AVENUE – LANGLEY

![]() 19 19628 55A Avenue

19 19628 55A Avenue

![]() 3 bed

3 bed

![]() 548 sq ft Rooftop patio with views

548 sq ft Rooftop patio with views

![]() 2 parking

2 parking

![]() 1474 sq ft

1474 sq ft

![]() Offered at $879,900

Offered at $879,900

Welcome to LIFT! This 3 bed, 3 Bath home, built in 2020 has a modern feel & features with a light, bright open floor plan, nest smart home & central A/C included! Main floor has a powder room & great size dining room, opening to a west facing balcony with unobstructed views. Showstopper kitchen Centred on main floor, white shaker cabinets, SS appliances incl gas stove, elegant quartz counters, large island with waterfall edge & built in microwave. Living room has tons of space for furniture & is perfect for the whole family. 3 great size bedrooms up, family bathroom & primary suite with his & hers closets & Ensuite. The outside space continues on the ultra sunny roof top deck with great views & tons of space for entertaining. 2 parking in the garage & ample storage.

For more information, measurements and walk through video visit https://garryvoigt.com/…/19-19628-55a-avenue-langley…/